The Real Cost of Living in Mumbai: No Sugar-Coating

Let’s skip the polite small talk. Finding a place to live in Mumbai feels like trying to negotiate with a pickpocket while he’s already walking away with the wallet. Deposits, brokers, “maintenance,” surprise charges that appear out of nowhere like a plot twist no one asked for. Fun, right?

Everyone’s selling a dream. Co-living looks like a dream on Instagram—fairy lights, bean bags, “community events” with lukewarm pizza. Rentals scream “independence,” then send the bill for it. And PGs? They’re the boring, dependable friend who shows up on time and reminds everyone to hydrate. Boring wins more often than people think.

Here’s the uncomfortable, wallet-friendly truth: if saving money actually matters, PGs are the move. Not forever. Not for clout. For now—when every rupee counts.

The Real Cost (aka Not Just “Monthly Rent”)

Most people compare monthly rent like it’s the whole story. It’s not. That’s like judging a thali by the rice and ignoring the six bowls of stuff that come with it.

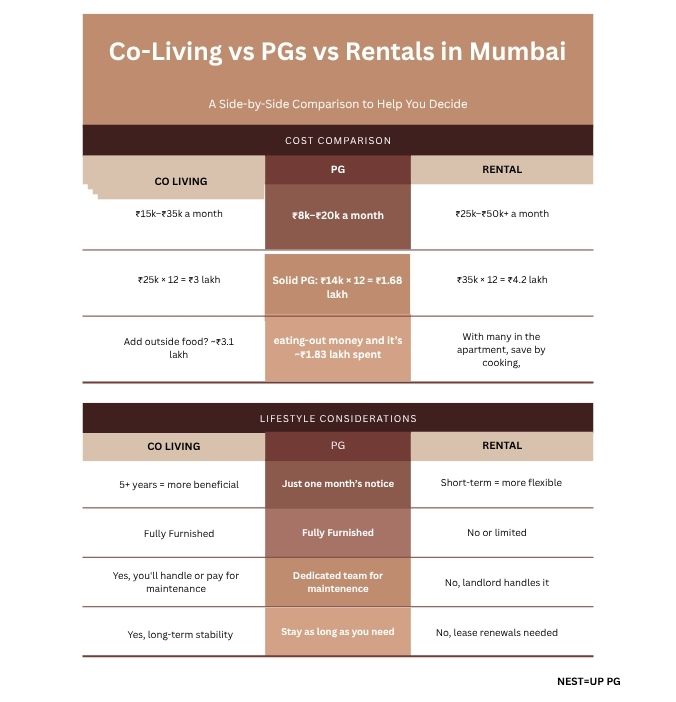

- PGs: ₹8k–₹20k a month depending on area and sharing. Deposit? One, maybe two months. Walk in with a backpack, walk out with your sanity intact.

- Co-living: ₹15k–₹35k for the same square footage plus dog-and-pony shows—game rooms, meetups, neon signs that say “vibes.”

- Rentals: ₹25k–₹50k+ for a 1BHK, plus a soul-punching 10-month deposit, one month to the broker, furniture, WiFi, electricity, gas, and landlord drop-ins.

Want a Story? Here’s One

Priya rents a studio in Andheri because “space.” First swipe: ₹30k rent + ₹3 lakh deposit + ₹30k broker. That’s ₹3.6 lakh before she buys a spoon. Add ₹40k furniture, ₹15k kitchen basics, ₹3k WiFi install, ₹5k electricity deposit. She’s basically crowd-funded her landlord’s vacation.

Monthly outgoings? ₹37,700 before food. Meanwhile, Rahul moves into a clean PG in Goregaon East for ₹14k. Electricity, WiFi, two meals, laundry, cleaning—done. Deposit? ₹28k. He saves. She… meal-preps and cries a little.

What PGs Get Right (and Why It Matters)

- Minimal upfront pain: 1–2 months’ deposit. Not 10. Keep the kidney.

- All-inclusive bills: Rent + electricity + WiFi + food + cleaning + laundry.

- Flexibility: 30-day notice and bounce. Co-living has lock-ins. Rentals have contracts that age like milk.

The Math That Slaps

- Solid PG: ₹14k × 12 = ₹1.68 lakh. Add a little eating-out money and it’s ~₹1.83 lakh spent.

- Co-living: ₹25k × 12 = ₹3 lakh. Add outside food? ~₹3.1 lakh.

- 1BHK: ₹35k × 12 = ₹4.2 lakh, plus furniture and utilities. You’re easily at ~₹5.64 lakh actually spent.

That means a PG can save roughly ₹1.27 lakh vs co-living and ₹3.81 lakh vs a rental—in one year. That’s not a rounding error. That’s a bike, a trip, or the emergency fund everyone swears they’ll start “next month.”

“But What About Quality of Life?”

Yes, bad PGs exist. So do landlords from the 90s and co-livings that are all sizzle, no steak. Good PGs are different: professional management, CCTV, access control, decent food, actual cleaning, responsive maintenance, and WiFi that doesn’t give up during a Teams call. They’re not fancy. They just work.

Location, Location, Don’t-Get-Fleeced

Co-living will tell you “we’re closer to work.” Great. So are plenty of PGs. Pick a good PG near the office and skip the 90-minute one-way commute that slowly melts your will to live.

The “Community” Myth

Co-living markets community like it’s a feature you can’t find anywhere else. Reality check: people make communities, not foosball tables. PGs naturally create bonds—meals, matches, study sessions, weekend plans. Organic beats orchestrated.

Who Should Pick What (No Nonsense Edition)

- Pick a PG: New to the city, early-career, want flexibility and savings.

- Pick co-living: Need plug-and-play comfort, value curated amenities.

- Pick a rental: Planning long-term, prioritize privacy, have cash for deposits.

The Part Nobody Posts on Instagram

PGs won’t get clout. They’ll get compounding savings. Five years from now, the person who picked pragmatic over performative will have lakhs saved and options on the table. That’s the real flex.

Quick FAQ (No Fluff, Just Answers)

- How much deposit do PGs charge? Usually 1–2 months; far cheaper than rentals.

- Are PGs safe for women? The good ones are—CCTV, access control, visitor rules, and solid reviews.

- What’s included in PG rent? Stay, electricity, WiFi, furniture, cleaning, laundry, and in premium PGs, meals as well.

- Can guests visit? Daytime yes; overnights usually no.

- Notice period? Typically 30 days; sometimes 15.

- Can I cook? Depends on the PG. Ask before you book; light kitchenette use sometimes allowed.

- Is WiFi good for work-from-home? Often 50–100 Mbps; test before paying.

Bottom Line

If the goal is to save money without losing sanity, PGs win today so there’s actual freedom tomorrow. It’s not glamorous. It’s just smart. And in Mumbai, smart beats pretty—every. single. time.